TNSCERT XII Standard Accountancy Model Question Paper 2019 : Educational Research and Training Tamilnadu

Organisation : State Council of Educational Research and Training Tamilnadu

Exam : Higher Secondary Second Year

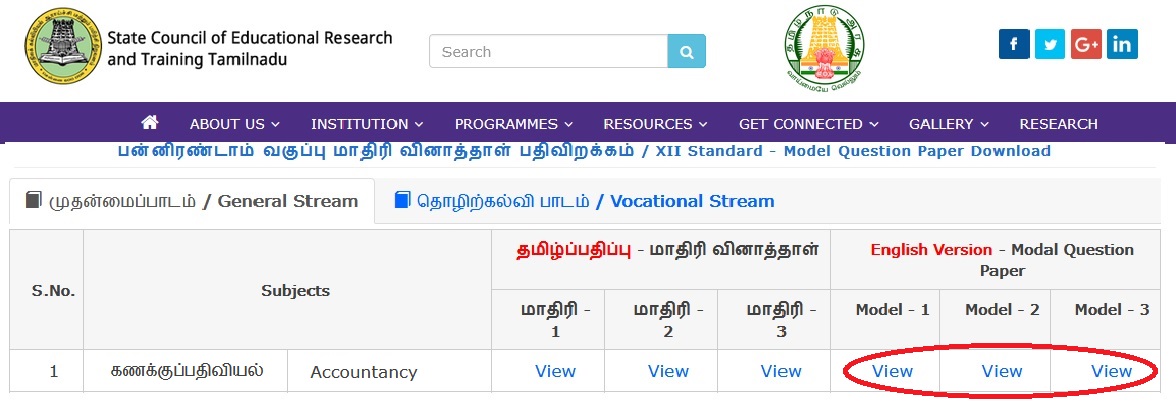

Document Type : XII Standard – Model Question Paper Download

Category or Subject : Accountancy

Website : http://www.tnscert.org/webapp2/xiimodelquestionspaper.aspx

TNSCERT XII Standard Accountancy Model Question Paper

The Government of Tamil Nadu has taken a policy decision on reducing the maximum marks for Higher Secondary Board Examination from 1200 to 600 in order to reduce the examination stress of students besides reducing the number of papers for Language subjects from two to one.

Related : TNSCERT XII Standard Commerce Model Question Paper 2019 : www.pdfquestion.in/34024.html

Note :

** These are only model questions. Teachers and students need to focus only on the Pattern of the questions.

Accountancy

Time : 2.30 Hours

Marks : 90

Part-I

Choose the correct answer: 20×1=20

1. Return outwards are deducted from……………………………….

a. Purchases

b. Sales

c. Gross Profit

2. The financial position of the business can be ascertained by preparing…………………………

a. Trading and Profit loss

b. Trial balance

c. Capital accounts

3. Rent outstanding is………………………..

a. Liability

b. Asset

c. Income

4. Under the net worth method the basis for ascertaining the profit is the difference between………………..

a. The capital on two dates

b. Assets on two dates

c. Liabilities on two dates

5. A firm has capital of Rs.60,000/- and liabilities of Rs.40,000/- then its assets is…………………………

a. Rs.1,00,000/-

b. Rs.20,000/-

c. Rs. 40,000/-

Download Question Paper :

Model – 1 :

https://www.pdfquestion.in/uploads/pdf2019/34029-Acc1.pdf

Model – 2 :

https://www.pdfquestion.in/uploads/pdf2019/34029-Acc2.pdf

Model – 3 :

https://www.pdfquestion.in/uploads/pdf2019/34029-Acc3.pdf

6. If selling price is less than the book value of the asset it denotes………………………

a. Profit

b. Loss

c. Expense

7. Cost of asset Rs.5,00,000/-. Rate of depreciation is 10% p.a under diminishing balance method. Book value of the asset under the end of second year is………………………….

a. Rs.4,05,000/-

b. Rs.4,00,000/-

c. Rs.95,000/-

8. The amount of depreciation charged on a machinery will be debited in………………………..

a. Machinery account

b. Depreciation account

c. Cash account

9. Opening stock is Rs.20,000/-. Purchases Rs.4,00,000/- and closing stock is Rs.10,000/-. Cost of goods sold is…………………………….

a. Rs.4,30,000/-

b. Rs.4,20,000/-

c. Rs.4,10,000/-

10. Share holders fund include……………………

a. Equity share capital, Preference share capital, Reserves and surplus.

b. Loans from banks and financial institutions

c. Equity share capital, Preference share capital, Reserves and surplus and Loans from bank and financial institutions.

11. Redemption of debenture is an example for…………………………….

a. Cash receipts

b. Cash payments

c. None of The above

12. Budget is expressed in terms of……………………………..

a. Money

b. Physical units

c. Money and physical units

13. If a firm is maintaining both “Capital Accounts and Current Accounts of the partners A and B. Additional capital introduced by B will be recorded in…………………………….

a. B’s current account

b. B’s capital account

c. Either B’s capital account or current account

14. When a fixed amount is withdrawn in the beginning of every month, the period calculated for interest on drawings is…………………………..

a. 11/24

b. 12/24

c. 13/24

15. Revaluation Account is a…………………………….

a. Real account

b. Nominal account

c. Personal account

16. A & B are sharing profits in the ratio of 3:2. C is admitted as a partner giving him 1/5th share of profits. This will be given by A & B ………………………………

a. Equally

b. In the ratio of their profits

c. In the ratio of their capitals

17. When the amount due to an outgoing partner is not paid immediately, then it is transferred to…………………….

a. Capital account

b. Loan account

c. Cash account

18. …………………………..ratio is calculated by taking out the difference between new profit sharing ratio and old profit sharing ratio

a. Gaining

b. Capital

c. Sacrifice

19. Premium on issue of shares can be used for………………………….

a. Issue of fully paid bonus shares

b. Distribution of profit

c. Transferring to general reserve

20. The maximum calls a company can make is……………………….

a. One

b. Two

c. Three

Part-II

Answer any 7 questions: (Question No.21 is compulsory) 7×2=14

21. What is accrued income?

22. Define single entry system.

23. Write notes on Effluxion of time

24. Name any two current assets which are not considered to be liquid assets

25. May June July

Cash sales 1,37,500 1,62,500 2,37,500

Credit sales 1,37,500 1,72,500 2,00,000

Note: Credit allowed to customers is one month. Show the cash receivables from customers for the month of June & July.

26. How does the ‘factor efficiency of management’ affect the goodwill of the firm?

27. If the partnership deed does not specify the rate of interest chargeable on drawings, will the interest still be charged? If yes, at what rate, if not why?

28. State any two purposes of admitting a new partner in a firm.

29. Define gaining ratio

30. Give the meaning of over subscription of shares?

Part-III

Answer any 7 questions: (Question No.31 is compulsory) 7×3=21

31. Give adjusting and transfer entry for depreciation on machinery Rs.25,000/-

32. Calculate the missing figure:

Capital at the end Rs.1,60,000

Capital at the beginning Rs.1,20,000

Profit made during the year Rs.64,000

Additional capital introduced Rs.20,000

Drawings ?

33. Find the rate of depreciation under straight line method.

Cost of plant Rs.2,30,000

Installation charges Rs.20,000

Expected life in years 10 years

Scrap value Rs.50,000

34. Calculate Gross Profit Ratio

Sales Rs.6,50,000

Cost of goods sold Rs.4,80,000

Sales return Rs.50,000

35. What are the characteristics of budget?

36. X and Y are partners sharing profits and losses equally. X draws regularly Rs.3000/- at the beginning of every month during the year. Y draws regularly Rs.2000/- at the end of every month during the year. Calculate interest on drawings @ 10% p.a.

37. What are the differences between fixed capital account and fluctuating capital account? (any 3)

38. Ravi and Raja are partners sharing profits in the ratio of 7:3. They admit Rajesh into partnership for 1/5th share, old partners sacrificing equally. Calculate the new profit ratio?

39. A Ltd. Invited applications for issuing 5,00,000 equity shares of Rs.10 each at a premium of Rs.5 per share. Because of favourable market conditions, the issue was oversubscribed. Suggest the alternatives available to the board of directors for the allotment of shares.

40. Vinod Company Ltd. Issued 40,000 preference shares of Rs.10 each at a premium of Rs.3. Give journal entry.

Part-IV

Answer all the questions: 7×5=35

41. a) Trial balance shows on 31.03.2007, sundry debtors Rs.52,000/-. Adjustments:

1. Bad debts to be written off Rs.2000

2. Provision for bad and doubtful debts be created at 5%

3. Provide discount on debtors at 2% Pass adjusting entries and also show how these items will appear in the final accounts.

(or)

b) Mr.Suresh keeps his books by incomplete double entry system. He started business with Rs.1,00,000/- on 01.04.2007. On 30.03.2008 his position was under:

Bank balance Rs.20,000

Stock Rs.30,000

Sundry debtors Rs.70,000

Machinery Rs.50,000

Cash in hand Rs.10,000

Bills receivables Rs.30,000

Sundry creditors Rs.40,000

Bills payable Rs.20,000

Outstanding expenses Rs.5,000

During the year he introduced Rs.35000 as additional capital. He has withdrawn Rs.2000 per month for his personal use. Find out his profit or loss for the year 2007-2008.

42. a) The following balances are extracted from the books of Mr.Kavin as on 31st March 2004. Prepare Trading, Profit & Loss A/c and Balance Sheet.

Adjustments:

1. Closing stock Rs.1,00,000/-

2. Wages yet to be paid Rs.2,000/-

3. Commission accrued and not yet received Rs.1,000/-

4. Quarterly premium of insurance is paid in advance.

(or)

b) Prepare capital accounts of the partners Ravi and Raja from the following details assuming that their capitals are fluctuating.

43. a) The books of Mr.Ravi revealed the following information on 01.04.2000. Prepare Trading and Profit & Loss A/c and Balance Sheet as on 31.03.2001.

(or)

b) Mala and Geetha are partners sharing profits & losses in the ratio of 3:2. They decided to admit Latha in to partnership and revalue the assets & liabilities as under.

1. To bring into record investment of Rs.12,000/- which had not so far been recorded in the books of the firm.

2. To depreciate stock, furniture & machinery by Rs.3,000/-, Rs.1,000/- & Rs.5,000/- respectively.

3. A provision for outstanding liabilities was to be created for Rs.4,000/-. Give journal entries & show the revaluation account.

44. a) Navin & Nithin were partners of a firm showing profit & loss in the ratio of 7:5. Set out below was their balance sheet as on 31st December 2004.

Nitin retired from the partnership from 1st January 2005 and that Navin will take over the business on the following terms.

1. Goodwill was to be valued at Rs.36,000/-

2. Machinery was depreciated at 10%

3. Provision for doubtful debts created at 5% on sundry debtors

4. The liability on workmen’s compensation fund is determined at Rs.36,000/- Show revaluation A/c and Capital A/c & Balance Sheet of the reconstituted firm.

45. a) Sunita Limited issued 1000 shares of Rs.10 each at Rs.12 per share. The amount is payable as under.

Rs.3/- on application

Rs.5/- on allotment (including premium)

Rs.2/- on first call

Rs.2/- on final call.

1. The company did not make the final call. Mr. Mani was allotted 25 shares. Give Journal entries for forfeiture in the following case. Mr. Mani failed to pay first call money and his shares were forfeited.

2. Company made all the calls. Mr. Mani failed to pay first call & final call money, his shares were forfeited. Give journal Entry for forfeiture

(or)

b) Machinery Account showed a balance of Rs.40,000/- on 1st April 2001. On 1st October 2003, another machinery was purchased for Rs.48,000/-. On 30th September 2003, a machinery which has book value of Rs.40,000/- on 01.04.2001 was sold for Rs.24,000/-. Depreciation is to provided at 10% p.a. on written down value method. The accounting year ends on 31st March. Prepare Machinery A/c for three years.