pue.kar.nic.in II PUC Exam Accountancy Question Paper : Karnataka Pre-University Education

Organization : Karnataka Department of Pre-University Education

Exam : II PU Accountancy

Document type : Question Paper

Website : pue.kar.nic.in

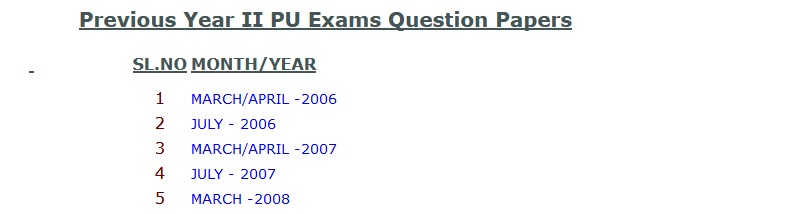

Download Previous/ Old Question Papers :

April 2006 : https://www.pdfquestion.in/uploads/pue.kar.nic.in/5960-a0630.pdf

July 2006 : https://www.pdfquestion.in/uploads/pue.kar.nic.in/5960-j0630.pdf

April 2007 : https://www.pdfquestion.in/uploads/pue.kar.nic.in/5960-a0730.pdf

July 2007 : https://www.pdfquestion.in/uploads/pue.kar.nic.in/5960-j0730.pdf

March 2008 : https://www.pdfquestion.in/uploads/pue.kar.nic.in/5960-a0830.pdf

June 2008 : https://www.pdfquestion.in/uploads/pue.kar.nic.in/5960-j0830.pdf

March 2009 : https://www.pdfquestion.in/uploads/pue.kar.nic.in/5959-m0929.pdf

July 2009 : https://www.pdfquestion.in/uploads/pue.kar.nic.in/5960-j0930.pdf

March 2010 : https://www.pdfquestion.in/uploads/pue.kar.nic.in/5960-m1030.pdf

July 2010 : https://www.pdfquestion.in/uploads/pue.kar.nic.in/5960-j1030.pdf

March 2011 : https://www.pdfquestion.in/uploads/pue.kar.nic.in/5960-m1130.pdf

July 2011 : https://www.pdfquestion.in/uploads/pue.kar.nic.in/5960-j1130.pdf

March 2014 :https://www.pdfquestion.in/uploads/pue.kar.nic.in/5960-m1430.pdf

PUE Accountancy Question Paper

New Scheme ( For Students studied during the Year 2005-2006 )

Total No. of Questions : 21 ] [ Total No. of Printed Pages : 16

Related / Similar Question Paper :

PUE Karnataka II PUC Physics Question Paper

March / April 2006

( New Syllabus ) Time : 3 Hours ] [ Max. Marks : 90

SECTION – A

Answer any eight questions, each carrying two marks. 8 × 2 = 16

1. State any two features of Single Entry System.

2. What is partnership –

3. What is Revaluation account –

4. Give the Journal entry for realisation expenses paid on dissolution of firm.

5. State any two types of shares of a public company.

6. Under what headings are the following items shown in the company’s Balance

SECTION – B

Answer any three questions, each carrying six marks. 3 × 6 = 18

11. Savitha, a partner withdrew Rs. 1,000 on 1st of every month for the half

year ending 30th June, 2004. Calculate the interest on drawings at

6% p.a. under product method.

12. Kiran, Naveen and Sunil are partners sharing profits and losses in the

ratio of 2 : 2 : 1. Kiran retires. His share is taken over by Naveen and

Sunil in the ratio of 3 : 2.

Calculate the new profit and loss sharing ratio.

Code No. 30-NS 10

13. X, Y and Z are partners sharing profits and losses in the ratio of 3 : 2 : 1.

Their Balance Sheet as on 31. 12. 2004 was as follows :

Liabilities Rs. Assets Rs. S. Creditors 20,000 Cash 6,000 Bills payable 6,000 Debtors 24,000

Reserve fund 24,000 Stock 20,000 Capitals : Furniture 10,000 X 20,000 Machinery

SECTION – C

Answer any four from the following questions, each carrying fourteen marks :

16. Manu kept his books under Single entry system and provides you the

a) Depreciate Furniture and Motor car at 10% P.A.

b) Appreciate building by 20%. c) Of the debtors Rs. 500 is irrecoverable and provide R.B.D. at 5% on

d) Rent due but not paid Rs. 1,000 and interest due but not received

17. Rajesh and Ramesh are partners sharing profits and losses in the ratio of

18. On 1.1.1996 a firm purchased a machinery costing Rs. 30,000. On

1. 7. 1998 it sold a part of the machinery costing Rs. 12,000 ( on

1. 1. 1996 ) for Rs. 8,800 and on the same date a new machinery was

19. Anitha and Sunitha are partners sharing profits and losses equally. Their

Balance Sheet as on 31. 12. 2004 was as follows :

Liabilities Rs. Assets Rs. Bills Payable 6,000 Cash at Bank 10,000 Creditors 20,000 B/R 4,000

a) The assets realised as follows : Bills Receivable Rs. 3,800 Debtors Rs. 25,800

b) Investment was taken over by Anitha at Rs. 10,000 and furniture

c) Dissolution expenses Rs. 2,600. Prepare :

i) Realisation Account ii) Partners’ Capital Accounts iii) Bank Account.

March / April, 2007

Section – A :

Answer any eight questions, each carrying two marks. 8 × 2 = 16

1. What are the two disadvantages of single entry system ?

2. What are the two methods of maintaining capital accounts in partnership business ?

3. How do you close Revaluation account in admission of a partner ?

4. State the different types of shares that can be issued by a public company.

5. Give the journal entry for the asset taken by a partner in dissolution of a firm.

6. Under what headings do you show the following in Company’s Balance sheet ?

a) Share premium

b) Discount on issue of shares.

7. What is Depreciation ?

8. What are non-trading concerns ?

9. State any two limitations of Computerised Accounting.

10. What is Computerised Accounting ?

Section – B :

Answer any three questions, each carrying six marks. 3 × 6 = 18

11. Ganesh has withdrawn as shown below :

Rs. 1,000 on 28. 02. 2006

Rs. 3,000 on 01. 07. 2006

Rs. 2,000 on 31. 08. 2006

Rs. 4,000 on 01. 10. 2006.

Calculate interest on drawings at 12% p.a. under product method for accounting year ended 31. 12. 2006.

12. A, B and C are partners sharing profits in the ratio of 12 , 13 & 16 respectively. A retires from the business. B and C decide to continue as equal partners. Calculate the gain ratio of B and C.

13. Ashok, Balu and Chandra are partners sharing profit and loss in the ratio of 2 : 2 : 1. Their capitals on 1. 1. 2005 was Rs. 50,000, Rs. 30,000 and Rs. 25,000 respectively.

Ashok died on 1. 7. 2005. Parternership deed provides the following :

a) Salary to Ashok Rs. 400 per month.

b) Interest on Capital at 10% p.a.

c) His share of Goodwill, Profit and Reserve. Goodwill of the firm valued at Rs. 25,000. Profit of the firm valued at Rs. 7,000. Reserve of the firm valued at Rs. 15,000. Prepare Ashok’s Capital a/c.

14. ABC Company Limited forfeited 700 shares of Rs. 10 each for nonpayment of 1st call Rs. 2 per share and final call of Rs. 3 per share. These forfeited shares were reissued as fully paid up at Rs. 8 per share. Give necessary journal entries.

15. What are the features of Computerised Accounting ?

Please post model papers and practical questions for 2018-19.

Please give me the questions with answers and please send me the question paper for accountancy final exams.

Please send me the question papers of Accountancy final exam 2017.

Great site. Thanks for providing Karnataka PUC II Accountancy question papers for 2006 to 2011 (both main and supplementary) and for March 2014.

I need the sample question papers from 2014 to 2017.

Please give the answers to all questions.

Very Good Details PDF was Informative. Thanks for the PDF

Please say The way of solving the whole question paper. We should solve randomly or serial wise?

Please tell me that why balance sheet always should be equal?

That is in the name of the statement only.

“Balance” Sheet means the balances of Credits should always be equal to the balances of the debits. This is the basic rule of double entry system. Double-entry accounting is based on the fact that every financial transaction has equal and opposite effects in at least two different accounts. It is used to satisfy the equation Assets = Liabilities + Equity, in which each entry is recorded to maintain the relationship.

Please give answer to all question