FM2106 Security Analysis & Portfolio Management M.B.A Question Bank : uou.ac.in

Name of the University : Uttarakhand Open University

Degree : M.B.A

Department : Financial Management

Subject Code/Name : FM2106 Security Analysis and Portfolio Management

Year : II

Semester : IV

Document Type : Old Question Papers

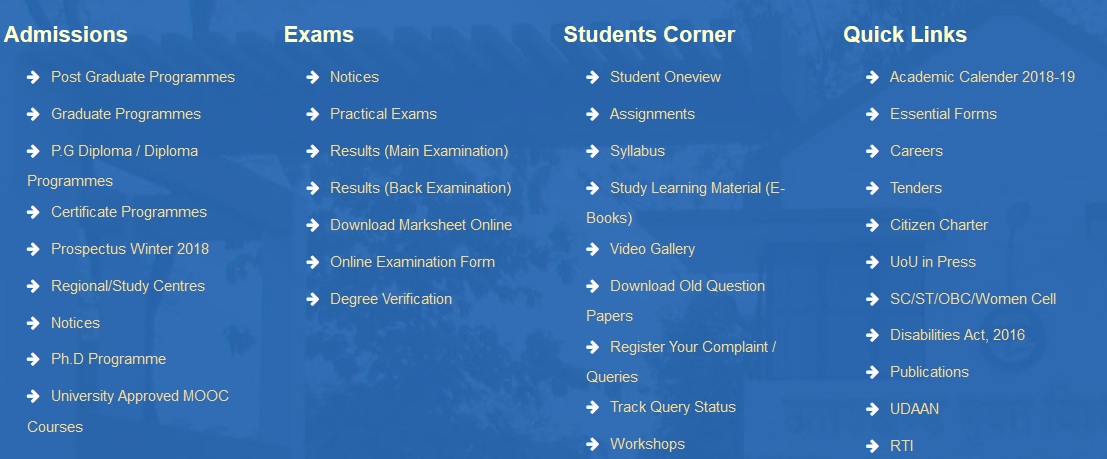

Website : uou.ac.in

Download Model/Sample Question Paper : https://www.pdfquestion.in/uploads/uou.ac.in/4339.-FM-2106.pdf

UOU Security Analysis & Portfolio Management

M.B.A- Second Year (Fourth Semester) Examination-2012

Time : 3 Hours

Maximum Marks: 60

Related / Similar Question Paper : UOU MBA Management of Financial Services Question Paper

Note- The question paper is divided into three sections A, B and C

Section-A

Section ‘A’ contains 04 long answer-type questions of 15 marks each. Learners are required to answers 02 questions only. 2×15=30

1. Define the term ‘investment’. As an investment advisor what features would you suggest to be included in the investment portfolio of a client?

2. Discuss the growth of trading rules, instruments and market participants’ operations in the Indian Capital Market.

3.Define the Efficient Market Hypothesis in each of its three forms. What are its implications?

4.a) Explain the Capital Asset Pricing Theory and its validity in the stock market.

b) Assume that the risk free rate of return is 7%; the market portfolio has an expected return of 14% and a standard deviation of return of 25%.Under the equilibrium condition as described by the CAPM, what would be the expected return for a portfolio having no unsystematic risk and 20% standard deviation of return?

Section-B

(Short Answer Type Questions)

Section ‘B’ contains 08 short answer type questions of 5 marks each. Learners

are required to answers 4 questions only. Answers of short answer-type

questions must be restricted to 250 words approximately. 4×5 = 20

Answer any four of the following;

1. Differentiate between Investment and Speculation.

2.What are the risks faced by a Portfolio Manager-

3. Why does an investor need stock market indices-

4. What do you mean by Portfolio Management-

5. Sangam Enterprises recently paid an annual dividend

6.How does technical analysis differ from fundamental analysis-

7. What are the basic features of futures-

8.What is simple diversification-

Section- C

(Objective Type Questions)

Section ‘C’ contains 10 objective-type questions of 01 mark each. Learners are required to answers all the questions.

10×1=10

Write True/False against the following.

1. The selection of a portfolio depends on the various objectives

2. A portfolio manager has to operate as per the code of conduct

3. Investment in government securities carries a higher element

4. Business Risk in a company is associated with the capital structure

5. Sangam Enterprises recently paid an annual dividend of Rs. 3.50 per share. Earnings for the same year were Rs. 7.00 per share. The required return on equity with similar risk is 12%.Dividends are expected to grow 10% per year indefinitely.Calculate Sangam’s ‘normal’ price-earnings ratio.

6.How does technical analysis differ from fundamental analysis?

7. What are the basic features of futures?

8.What is simple diversification?

Section- C : (Objective Type Questions)

Section ‘C’ contains 10 objective-type questions of 01 mark each. Learners are required to answers all the questions. 10×1=10

Write True/False against the following.

1. The selection of a portfolio depends on the various objectives of the investor.

2. A portfolio manager has to operate as per the code of conduct prescribed by SEBI.

3. Investment in government securities carries a higher element of risk.

4. Business Risk in a company is associated with the capital structure of the company.

5. Stock exchanges are a part of primary market segment.

Choose the correct alternative :

6. What is a call?

a. An option to sell stock at a specified price

b. An option to buy stock at a specified price

c. An option to sell stock on a specified date

d. An option to buy stock on a specified date

7. Among the following which technique makes the bond portfolio holder relatively certain about the promised stream of cash flows?

a. Demutualisation

b. Immunisation

c. Securitisation

d. Corporatisation

8.What is the Beta, of risk-free investment?

a. Zero

b.1

c.-1

d. None of these.

9.Which of the following is not a measure for evaluation of a portfolio?

a. Sharpe’s Performance Index

b. Treynor’s Performance Index

c.Jensen’s Performance Index

d. BSE-Sensex

10. Which of the following will increase the required rate of return?

a. Increase in Interest Rates

b. Increase in Risk-free Rate

c. Increase in Degree of Risk-Aversion

d. All of the above

Can I get solutions please? I need it urgently.