FM2105 Management of Financial Services M.B.A Question Bank : uou.ac.in

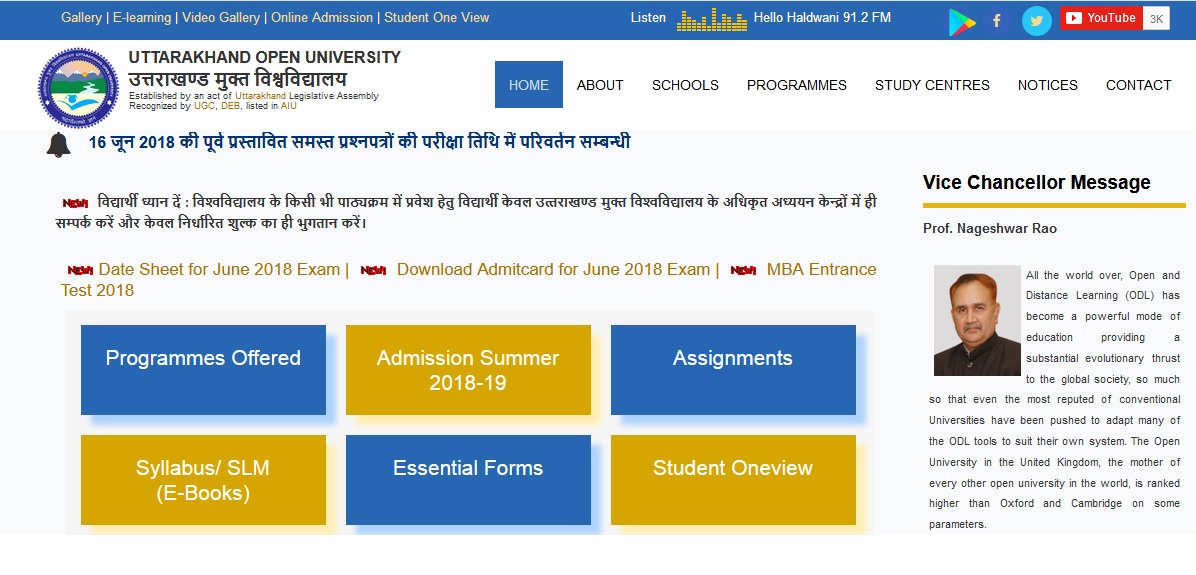

Name of the University : Uttarakhand Open University

Degree : M.B.A

Department : Financial Management

Subject Code/Name : FM2105 Management of Financial Services

Year : II

Semester : IV

Document Type : Old Question Papers

Website : uou.ac.in

Download Model/Sample Question Paper : https://www.pdfquestion.in/uploads/uou.ac.in/4327.-FM-2105.pdf

UOU Management of Financial Services Question Paper

Fourth Semester, Examination 2012

Time : 3 Hours

Maximum Marks: 60

Related / Similar Question Paper : UOU MBA Indian Financial System Question Paper

Note : This question paper is divided into three sections A,B and C.

SECTION – A

(This section contains four long answer type questions of 15 marks each. Learners

are required to answer tow questions only) (2×15=30)

Q- 1 “The financial system provides the intermediation between savers and investors and promotes faster economic development.” Examine the statement and explain the functions, importance and components of the financial system.

Q-2. Discuss in detail the ‘ pre-issue’ activities undertaken by a merchant banker.

Q-3 What is credit rating? What key factors are considered in rating process? Discuss the limitations of credit rating.

Q-4Define leasing. What are its features? Explain the advantages and limitations of leasing. Discuss the status of leasing in India.

SECTION – B

(This section contains 8 short answer type questions of 5 marks each. Learners are

required to answer 4 questions only. Answer must be restricted to 250 words

approximately) (4×5=20)

Q- 1 Explain ‘cross border lease’ with the help of example.

Q- 2 Discuss the scheme of demutualization and corporatization

Q- 3 What in NAV of a mutual fund scheme- Discuss with suitable examples.

Q- 4 Explain the sources of funds for housing finance companies.

Q-5 Define mutual fund and state its advantages.

Q- 6 Discuss the meaning and feature of Venture Capital.

Q- 7 Describe the factors considered important for pricing of financial services.

Q- 8 Explain various factoring services and their advantages.

SECTION – C

(This section contains 10 objective type questions of 1 marks each. Learners are

required answer all the questions.

Identify True of False from the following.

Q- 1 A new company can freely price its issue of shares.

Q- 2 The corpus of the fund and its duration are prefixed

Q- 3 The most liquid financial market is the call money market.

Q-4 Building bought for hiring is a physical asset.

Q- 5 Zero coupon bonds are sold at a discount to par value.

Chose the most appropriate alternative :

Q- 6 Trade debts have to be assigned in favor of the finance company under;

(a) Discounting

(b) Forfeiting

(c) Factoring

(d) All of the above

Q-7 The pattern of investment of a mutual fund is oriented towards fixed income yielding securities under;

(a) Growth Fund schemes

(b) Income fund schemes

(c) Balanced fund schemes

(d) MMMF schemes.

Q-8 . An order for the purchase of securities at a fixed price is known as;

(a) Limit order

(b) Open order

(c) Discretionary order

(d) Stop loss order

Q-9 Under factoring, the factor acts in the capacity of;

(a) an agent of his client

(b) a trustee

(c) a holder for value

(d) an administrator

Q- 10 Which one of the following is a financial asset?

(a) Gold

(b)Silver

(c) Land

(d) Share

Fourth Semester Examination-2015 :

FM-2105 Management of Financial Services :

Section – A : (Long Answer Type Questions)

1. Discuss the role of financial services in the Growth of Indian Economy.

2. ‘Systematic Risk cannot be controlled but unsystematic risk can be reduced’. Explain this statement.

3. How would you classify the different kinds of investors? Discuss the kind of securities suitable for each of these investors.

4. Write short notes on the following :

(a) Net Asset Value (NAV)

(b) Money Market Mutual Funds

(c) Role of mutual funds in stock market

Section – B : (Short Answer Type Questions)

Note : Section ‘B’ contains eight (08) short-answer-type questions of five (05) marks each. Learners are required to answer any four (04) questions only. (4×5=20)

Briefly discuss any four (04) of the following :

1. Difference between Commercial banks and Merchant banks.

2. Agencies regulating financial services in India.

3. Advantages of financial institutions.

4. Services rendered by a factor to a client.

5. Benefits of venture capital.