NACEN Paper-I Central Excise Question Paper 2016 Departmental Examination Of Inspectors Of Central Excise

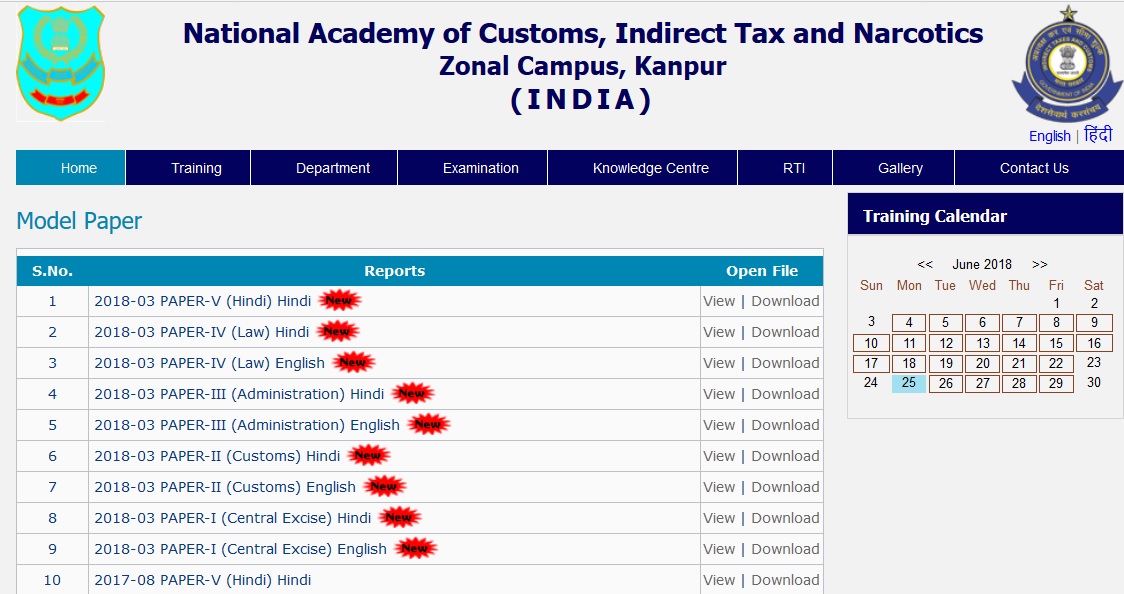

Name of the Organisation : National Academy of Customs Excise and Narcotics Regional Training Institute, Kanpur

Name of the paper : Departmental Examination Of Inspectors Of Central Excise

Name of the Subject: Paper-I Central Excise Question paper 2016

Year : 2015

Website : http://www.nacenkanpur.gov.in/model-paper.php

Download Sample Question Paper: https://www.pdfquestion.in/uploads/8168Papper-I.pdf

NACEN Paper-I Central Excise Question paper

Date: 20.01.2016

Maximum Marks : 100

Time : 2.00 PM to 5.00 PM

Pass Marks : 50

Related : NACEN Paper-III Administration Question Paper Departmental Examination Of Inspectors Of Central Excise : www.pdfquestion.in/8166.html

Note :-

1. All Questions are compulsory.

2. Candidates have options to answer in Hindi

3. Relevant authority must be quoted will all answers.

4. Use of Mobile/Smart Phones is strictly prohibited during examination.

Section A

Explain the following. Answer may be limited to 100 words. [2.5×8]

(a) What is “taxable event” for purpose of levy of Central Excise duty?

(b) Are goods manufactured in SEZ unit, excisable goods? Is supply made by DTA unit to SEZ

unit be treated as “physical export” for purpose of Central Excise?

(c) Recovery of Central Excise duty from buyer is an essential condition for levy of indirect tax.

(d) State briefly the sources of power in respect of Central Excise duty?

(e) Show Cause Notice is not required to be issued in remand proceedings.

(f) Redemption fine cannot be imposed when goods are physically not available for confiscation.

(g) Goods with „NIL? rate of duty cannot be treated as non-excisable goods.

(h) Whether remission of excise duty shall be granted under the Central Excise- Rules 2002 in acase where duty paid goods were damaged due to breakage in handling.

Section B

(a) What are the conditions for treating transaction value as the assessable value of excisable goods? [5]

(b) The Cum duty price of a product is Rs.150 per piece and the assessee paid duty @ 20%adv. Subsequently, it was found that rate of duty was 30% adv. and the assesee had not collected

anything over and above Rs.150 per piece from his buyer; determine the assessable value? Permissible deduction may be taken as NIL? [5]

(c) The price of a machine cleared on 20.08.2015 at Chennai to a buyer was Rs.4 Lakh

(Exclusive of Central Excise duty). Suddenly, the buyer refused to take delivery of the

machine. From 01.09.2015, the manufacturer at Chennai increased the price of machine to

Rs.4.20 Lakh with immediate effect. The manufacturer then sold the machine to another

buyer directly on 10.09.2015 at increased price of Rs. 4.20 Lakh. Find out the Central Excise

duty payable by the manufacturer taking rate of Central Excise duty 10%?

Section C

(a) What are the obligations of manufacturers who are availing Cenvat Credit on the inputs commonly used in the manufacture of dutiable as well as exempted goods? [10]

(b) A manufacturer has sent his inputs for job work under Rule 4(5) of Cenvat Credit Rules,2004. What is the time limit within which the goods should be returned to factory after job work? Explain the consequences if goods are not returned within the specified period? [5]

(c) A manufacturer purchased 1000 Kgs of inputs @ 100/- per Kg. During transit 50 Kgs. were stolen and the manufacturer received 950 Kgs. in the factory. Calculate the available input credit to the manufacturer. Rate of Central Excise duty is 10%.

Section D

(a) Name two situations where excise duty liability is not of the manufacturer but of the person who has supplied the raw material.

(b) State the “L.T.U.” & objective behind the concept of LTU

(c) there is difference of opinion about interpretation of a provision in Foreign Trade Policy among following authorities :

(i) Principal Chief Commissioner of Customs.

(ii) Director General of Foreign Trade.

(iii) Revenue Secretary, Ministry of Finance.

(iv) Chairman of CBEC.

Whose interpretation will be final and binding on the Central Excise Authorities?

(d) An assessee received a SCN. The demand of excise duty was confirmed against him by Commissioner (A). He feels that his case is not very strong and hence he is in two minds hether to approach settlement Commission or file an appeal with CESTAT? What appearsto be more proper?