Taxation LL.B Question Paper : kslu.ac.in

Name of the University : Karnataka State Law University

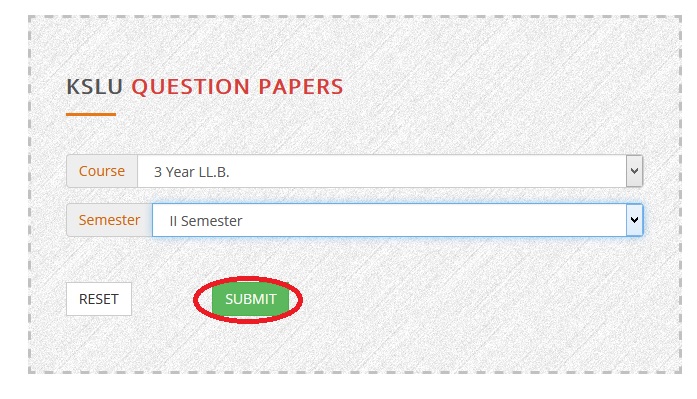

Degree : LL.B (3 years)

Subject Code/Name : Taxation

Year : III

Semester : VI

Document Type : Question Paper

Website : kslu.ac.in

Download Model/Sample Question Paper :

Dec-2012 : https://www.pdfquestion.in/uploads/kslu.ac.in/4713-85_0602.pdf

Jun-2013 : https://www.pdfquestion.in/uploads/kslu.ac.in/4713-a2_0602.pdf

Jan-2014 : https://www.pdfquestion.in/uploads/kslu.ac.in/4713-082_0602.pdf

KSLU Taxation Question Paper

Sixth Semester of Three Year LL.B. Examination, June/July 2012

Duration : 3 Hours

Max. Marks : 100

Related / Similar Question Paper :

KSLU LLB Law of Evidence Question Paper

June/July 2012

Instructions :

1. Answer all five Questions.

2. Figures to the right indicate marks.

3. Answer should be written completely either in English

UNIT – I

Q. No. 1. (a) What is meant by exempted income –

Explain which incomes are included under the head Income

(b) ‘A’ resident in India, receives Rs. 6 lakhs from Agricultural land situated in Sri Lanka. How this income is treated under the Write a note on short term capital gain.

UNIT – II

Q. No. 2. (a) Discuss the provisions of Income Tax Act, relating Appeal to the Income Tax Appellate tribunal. Marks : 15

“Certain assets of others are included for determining the Net wealth of an Individual under the Wealth Tax Act”. Elucidate.

(b) Write a note on Refund of Tax (I. T. Act). Marks : 5

Comment on Revision powers of Commissioner. (I. T. Act).

UNIT – III

Q. No. 3. (a) Explain the provisions relating to valuation of Excisable goods for the purpose of charging Excise duty. Marks : 15

“Duties specified in the schedule to the Central Excise Tariff Act, 1985 shall be levied”. Explain.

(b) Write a note on manufacture. Marks : 5

Make a note on Registration of certain persons.

UNIT – IV

Q. No. 4. (a) Discuss the provisions under the Customs Act relating to Dutiable goods and valuation of goods. Marks : 15

Explain the provisions relating to Assessment of duty under

(b) Write a note on appointment and powers of Customs Officers. Marks

Explain goods and prohibited goods (Customs Act).

UNIT – V

Q. No. 5. (a) Briefly explain the provisions relating to Registration of Dealer Under the C.S.T. Act. Marks : 15

When is a sale or purchase of goods said to be sale or purchase made in the course of Export or Import under the C. S. T. Act –

(b) Discuss on determination of turn over (C. S. T.). Marks : 5

Write a brief note on special features of V.A.T

December 2013

VI Semester Three Year LL.B. Examination, December 2013 :

Duration : 3 Hours

Max. Marks : 100

Instructions :

1. Answer all five questions.

2. One Essay type and one short note question or problem from each Unit have to be attempted which is referred as Part (a), Part (b) in all the Units.

3. Figures to the right indicate marks.

4. Answer should be written either in English or Kannada completely.

UNIT – I :

Q. No. 1. (a) Explain the concept, nature and characteristics of Income Tax.Marks : 15 OR

Explain the meaning of salary and various deductions of salary.

(b) Write a note on residential status. Marks : 5 OR

Distinguish between tax evasion and tax avoidance.

UNIT – II :

Q. No. 2. (a) Explain the composition, powers and functions of income tax tribunal. Marks : 15 OR

Explain the meaning of assets and deemed assets under Wealth Tax Act.

(b) Write a note on offences and penalties under Income Tax Act, 1961. Marks : 5 OR

Write a note on Permanent Account Number (PAN).

UNIT – III :

Q. No. 3. (a) Explain the provisions with respect to valuation of excisable goods for the purpose of charging of excise duty. Marks : 15 OR

Explain the composition, jurisdiction and powers of settlement authority under Central Excise Act.

(b) Write a note on registration and clearance of goods. Marks : 5 OR

Write a note on interest on the amount collected in excess of the duty under Central Excise Act.

UNIT – IV :

Q. No. 4. (a) Explain the prevention or detection of illegally imported goods under the Customs Act, 1962. Marks : 15 OR

Explain the various powers of Commissioner to search, arrest of suspected persons under the Customs Act, 1962.

(b) Write a note on power to grant exemption from duty under Customs Act, 1962. Marks : 5 OR

Write a note on drawbacks on imported raw materials in the manufacture of goods which are to be exported.

UNIT – V :

Q. No. 5. (a) When a sale or purchase is said to have taken place out side a state in the course of Trade or Commerce. Elucidate with case laws. Marks : 15 OR

Explain the goods of special importance in inter-state trade or commerce under Central Sales Tax Act, 1956.

(b) Write a note on Service Tax. Marks : 5 OR

Write a note on turnover and taxable turn over under Central Sales Tax Act, 1956.

I want GST recent question papers.

There is no answer from your side about model question and answer for study. We can’t able to find the right answer from indirect question in exams.

I need GST question paper.

B.A LLB & LLM question papers are available in the below link.

kslu.ac.in/index.php?/home/question

I need recent syllabus of taxation question paper.

I need KSLU GST question paper of 2018.

I need new model question paper regarding GST.

Please upload all five years ballb question papers