Commerce Ka Arjun Scholarship Program 2020-21 Sample Paper : commercekaarjun.com

Name of the Organisation : Vidya Sagar Institute

Name of the Exam : Commerce Ka Arjun Scholarship Program 2020-21

Applicable For : 12th Commerce Students

Document Type : Sample Paper

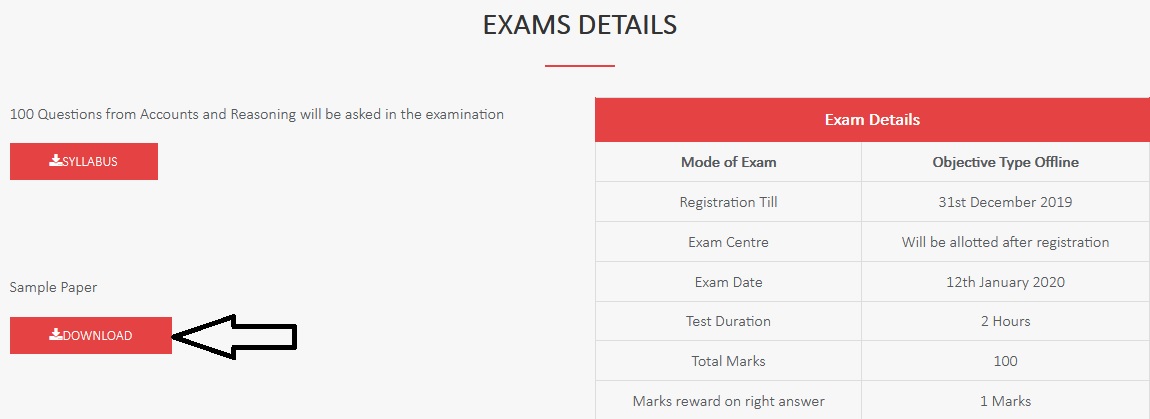

Exam Date : 12th January 2020

Website : http://www.commercekaarjun.com/

Commerce Ka Arjun Scholarship Sample Paper

Download the Sample Paper of Commerce Ka Arjun Scholarship Program 2020-21 from the official website of Vidya Sagar Institute.

Related / Similar Question Paper : VVM Question Papers

Instruction

Maximum Marks : 100

Time : 2 Hours

1. Use HB Pencil to fill ovals for correct answer.

2. Each question carry one mark.

3. Negative marking .25 marks

4. No negative marking for unattempted questions.

Question Paper

01. Ascertainment of financial position by

(a) Journal

(b) Ledger

(c) Balance sheet

(d) Profit & Loss a/c

02. Double entry book keeping has been developed in

(a) 15th century

(b) 16th century

(c) 19th century

(d) 20th century

03. Which of the following does not follow dual Aspect?

(a) Increase in one asset, decrease in other

(b) Increase in both asset and liability

(c) Decrease in one asset, decrease in other

(d) Increase in one asset & Capital

04. The accounting equation is based on

(a) Dual aspect

(b) Business Entity

(c) Going concern

(d) All of the above

05. Under which concept owner is treated as a creditor in business

(a) periodicity

(b) Materiality

(c) Business Entity

(d) Consistency

06. Ram starts business with cash Rs. 90,000 and then buys goods from Shyam on credit for Rs. 23,000. The accounting equation based on assets = Capital + Liabilities will be

(a) 1,13,000 = 90,000 +23,000

(b) 1,13,000 = 1,13,000 + 0

(c) 90,000 = 67,000 + 23,000

(d) 67,000 = 90,000 – 23,000

07. Which of the following is not a transaction?

(a) Goods are purchased on cash basis for Rs.1,000.

(b) Salaries paid for the month of May, 2006.

(c) Land is purchased for Rs.10 lacs.

(d) An employee dismissed from the job

08. Credit balances in the ledger will be

(a) A revenue or an asset

(b) An expense or an asset

(c) A revenue or a liability

(d) None of the three

09. “Debit the receiver and credit the Giver” is the golden rule for which type of account?

(a) Real A/c

(b) Personal A/c

(c) Nominal A/c

(d) None of these

10. Outstanding salary account is

(a) Real account

(b) Personal account

(c) Nominal account

(d) None of the above

11. Proprietor’s account is ___________ Account

(a) Real

(b) Nominal

(c) Personal

(d) None of these

12. Drawings are deducted from ________

(a) Sales

(b) Purchases.

(c) Expenses.

(d) Capital

13. Capital of business is Rs. 75,000 and liability is Rs. 25,000 then total assets of business will be

(a) Rs. 1,00,000

(b) Rs. 15,000

(c) Rs. 75,000

(d) Rs. 50,000

14. In ledger there are _______ columns

(a) 4

(b) 6

(c) 8

(d) 10

15. In case of debit balance, the words ______ are written on the debit side

(a) To balance b/d.

(b) To balance c/d.

(c) By balance b/d.

(d) By balance c/d.

16. The concept that “an accountant shouldn’t anticipate profit, but must provide for all losses” is known as

(a) conservatism concept

(b) consistency concept

(c) materiality concept

(d) realization concept

17. After the preparation of ledgers, the next step is the preparation of

(a) Trading account

(b) Trial balance

(c) Profit and loss account

(d) None of the above

18. The trial balance checks

(a) Valuation of closing stock

(b) valuation of assets

(c) valuation of liabilities

(d) Arithmetical accuracy of books of accounts.

19. The accountant of the firm M/s ABC is unable to tally the following trial balance.

S. No. Account heads Debit (Rs.) Credit (Rs.)

1 Sales 15,000

2 Purchases 10,000

3 Miscellaneous expenses 2,500

4 Salaries 2,500

Total 12,500 17,500

The above difference in trial balance is due to

(a) wrong placing of sales account

(b) wrong placing of salaries account

(c) wrong placing of miscellaneous expenses account

(d) Wrong placing of all accounts

20. The adjustments to be made for prepaid expenses is

(a) Add Prepaid expenses to respective expenses and show it as an asset

(b) Deduct prepaid expenses from respective expenses and show it as an asset

(c) Add prepaid expenses to respective expenses and show it as a liability

(d) Deduct prepaid expenses from respective expenses and show it as a liability

Download Sample Paper :

https://www.pdfquestion.in/uploads/pdf2019/34891-CKA.pdf

21. Goods sold for cash Rs. 10,000, plus 10% sales tax. Sales a/c will be credited by

(a) Rs. 11,000.

(b) Rs. 10,000.

(c) Rs. 9,000

(d) None of the above

22. Calls in advance are shown under which head of the Balance Sheet?

(a) Addition to Share Capital

(b) Separately under Head Share Capital

(c) Current Liability

(d) Fixed Liability

23. If the debit and credit aspects of a transaction are recorded in the cash Book, it is a

(a) Contra entry

(b) Simple entry

(c) Double entry

(d) Single entry

24. Material costing Rs.700 in the erection of the machinery and the wages paid for it amounting to Rs. 400 should be debited to

(a) Material account

(b) Wages account

(c) Purchases account

(d) Machinery account

25. When shares are forfeited ,the share capital account is debited with _____and the share forfeiture account is credited with________

(a) Paid-up capital of share forfeited; Called up capital of share forfeited

(b) Called up capital of share forfeited; Calls in arrear of shares forfeited

(c) Called up capital of share forfeited ; Amount received on shares forfeited

(d) Calls in arrears of share forfeited ; Amount received on share forfeited

26. Heavy amount spent on advertisement is__________

(a) Capital expenditure

(b) Revenue expenditure

(c) Deferred revenue expenditure

(d) None of the above

27. What would be treatment when plant & machinery is sold for Rs. 1,40,000 whose cost is Rs. 1,00,000 and WDV is Rs. 40,000

(a) Revenue receipt of Rs. 1,00,000

(b) Capital receipt of Rs. 1,00,000

(c) Capital profit of Rs. 40,000 and revenue profit of Rs. 60,000

(d) Capital receipt of Rs. 40,000 and revenue receipt of Rs. 60,000

28. Sales – Gross Profit =

(a) Cost of Goods Sold

(b) Purchases

(c) Opening Stock

(d) None of these

29. Carriage inwards is debited to

(a) Trading account.

(b) Profit and loss account

(c) Profit and loss appropriation account

(d) Balance sheet

30. Mohan paid Rs. 500 towards a debt of Rs. 2,500, which was written off as bad debt in the previous year. Mohan’s account will be credited with

(a) Rs. 2,500

(b) Rs. 2,000

(c) Rs. 500

(d) None of the three