CBSE Class XII Accountancy Sample Question Paper 2019-20 : cbseacademic.nic.in

Name of the Board : CBSE Academic

Class : XII STD

Document Type : Sample Question Paper

Subject : Accountancy

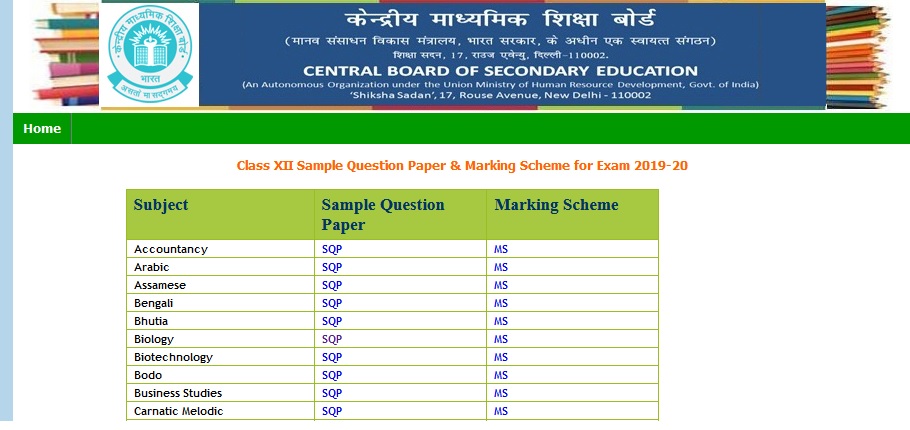

Paper : Class XII Sample Question Paper 2019-20

Year : 2019-20

Website : http://cbseacademic.nic.in/SQP_CLASSXII_2019_20.html

CBSE XII Accountancy Sample Question Paper

CBSE Academic Class XII Accountancy Sample Question Paper 2019-20.

Related : CBSE Class XII Biology Sample Question Paper 2019 : www.pdfquestion.in/34509.html

General Instructions

(i) This question paper contains two parts – A and B.

(ii) Part A is compulsory for all.

(iii) Part B has two options – Analysis of Financial Statements and Computerised Accounting.

(iv) Attempt only one option of Part B.

(v) All parts of a question should be attempted at one place.

Part A

How are the following items presented in financial statements of a Not-for- Profit organisation-

(a) Tournament Fund- Rs. 80,000

(b) Tournament expenses- Rs. 14,000

2. At what rate is interest payable on the amount remaining unpaid to the executor of deceased partner, in absence of any agreement among partners, when (s)he opts for interest and not share of profit.

(a) 12% p.a.

(b) 8% p.a.

(c) 6% p.a.

(d) 7.5%p.a.

3. State the order of payment of the following, in case of dissolution of partnership firm.

i. to each partner proportionately what is due to him/her from the firm for advances as distinguished from capital (i.e. partner’ loan);

ii. to each partner proportionately what is due to him on account of capital; and

iii. for the debts of the firm to the third parties;

4. A and B are partners in a firm having a capital of Rs. 54,000 and Rs. 36,000 respectively. They admitted C for 1/3rd share in the profits C brought proportionate amount of capital.

The Capital brought in by C would be

a) Rs. 90,000

b) Rs. 45,000

c) Rs. 5,400

d) Rs. 36,00

5. Amit, a partner in a partnership firm withdrew Rs. 7,000 in the beginning of each quarter. For how many months would interest on drawings be chargedRs.

6. Ankit, Unnati and Aryan are partners sharing profits in the ratio of 5:3:2. They decided to share future profits in the ratio of 2:3:5 with effect from 1st April,2018. They had the following balance in their balance sheet, passing necessary Journal Entry:

Particulars | Amount

Profit and loss Account (Dr) | 60,500

7. A and B are partners in a firm. They admit C as a partner with 1/5th share in the profits of the firm. C brings Rs. 4,00,000 as his share of capital. Calculate the value of C’s share of Goodwill on the basis of his capital, given that the combined capital of A and B after all adjustments is Rs. 10,00,000

8. Riyansh, Garv and Kavleen were partners in a firm sharing profit and loss in the ratio of 8:7:5. On 2nd November 2018, Kavleen died. Kalveen’s share of profits till the date of her death was calculated atRs. 9,375. Pass the necessary journal entry.

9. A and B are partners in a firm sharing profits and losses in the ratio of 3:2.On 1st April, 2019 they decided to admit C their new ratio is decided to be equal. Pass the necessary journal entry to distribute Investment Fluctuation Reserve ofRs. 60,000 at the time of C’s admission, when Investment appear in the books atRs. 2,10,000 and its market value is Rs.1,90,000.

10. ‘Complete the following statement’

When a liability is discharged by a partner, at the time of dissolution, Capital Account is credited because ______________ .

11. A and B are in partnership sharing profits and losses in the ratio of 3:2. They admit C into partnership with 1/5th share which he acquires equally from A and B. Accountant has calculated new profit sharing ratio as 5:3:2. Is accountant correctRs.

12. Wellness Co. Ltd. has issued 20,000, 9% Debentures of Rs. 100 each at a premium of 10% on 1st April, 2018 redeemable as follows:

31st March, 2021 – 10,000 debentures

31st March, 2022 – 4,000 debentures

31st March, 2023 – balance debentures.

It transferred to Debentures Redemption Reserve the required amount as applicable rules of the Companies Act and Rules, 2014 on due date. How much amount will be transferred to General Reserve on 31st March, 2021

a) Rs. 1,00,000

b) Rs. 2,50,000

c) Rs. 5,00,000

d) Rs. 20,00,000

Download Sample Question Paper 2019-20 :

https://www.pdfquestion.in/uploads/pdf2019/34561-Acc.pdf

Part B

13. What will be the effect on current ratio if a bills payable is discharged on maturityRs.

14. The two basic measures of operational efficiency of a company are

a) Inventory Turnover Ratio and Working Capital Turnover Ratio

b) Liquid Ratio and Operating Ratio

c) Liquid Ratio and Current Ratio

d) Gross Profit Margin and Net Profit Margin

15. Debt Equity Ratio of a company is 1:2. Purchase of a Fixed asset for Rs. 5,00,000 on long term deferred payment basis will increase, decrease or not change the ratioRs.

16. State the importance of financial analysis for labour unions.

17. M/s Mevo and Sons.; a bamboo pens producing company, purchased a machinery for Rs. 9,00,000. It received dividend of Rs. 70,000 on investment in shares. The company also sold an old machine of the book value of Rs. 79,000 at a loss of Rs. 10,000. Compute Cash flow from Investing Activities.

18. Common size analysis is also known as ———————— analysis. (fill in the blank)

19. While preparing Cash Flow Statement, match the following activities

I. Payment of cash to acquire Debenture by an Investing Company a. Financing activity

II. Purchase of Goodwill b. Investing Activity

III. Dividend paid by manufacturing company c. Operating activity

20. From the following details calculate Interest Coverage Ratio

Net profit after tax – Rs. 7,00,000

6% debentures of Rs. 20,00,000

Tax Rate 30%

Or

Under which major heads and sub-heads will the following items be placed in the Balance Sheet of the company as per Schedule III, Part I of the Companies Act, 2013Rs.

(i) Debentures with maturity period in current financial year

(ii) Securities Premium Reserve

(iii) Provident Fund