VTU MBA Model Question Paper 2018 : Visvesvaraya Technological University

Name of the University : Visvesvaraya Technological University

Name of the Exam : First Semester MBA Degree Examination

Paper : Accounting for Managers

Year : 2018

Document Type : Model Question Paper

Website : https://vtu.ac.in/

VTU MBA Model Question Paper

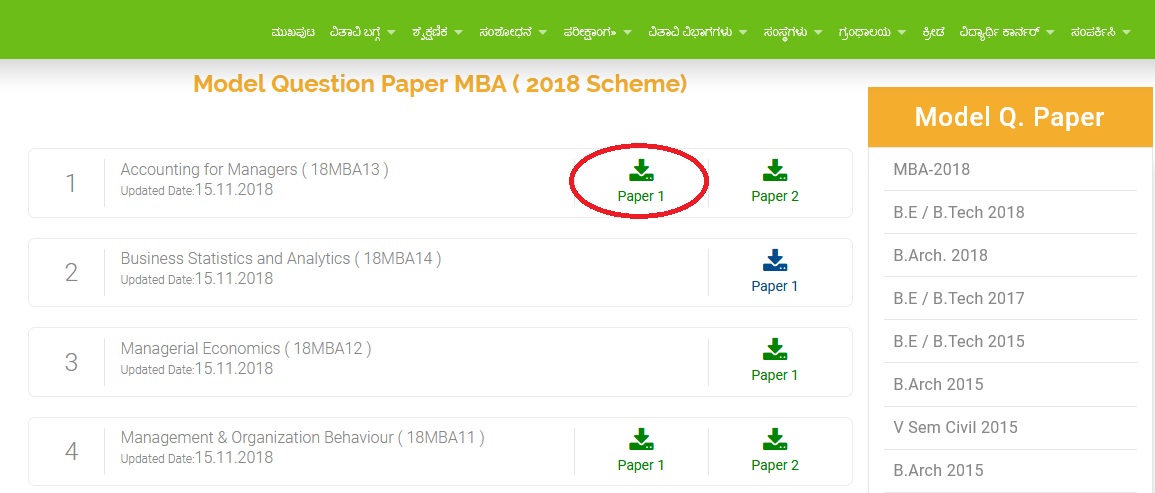

Download Question Paper of First Semester MBA Degree Examination Sample Question Paper is now available in the official website of Visvesvaraya Technological University

Related : VTU BE/B.Tech Computer Aided Machine Drawing Model Question Paper : www.pdfquestion.in/14136.html

Time: 3 hrs. Max.

Marks: 100

Note :

1. Answer any FOUR full questions from Part-A.

2. Part-B Case Study is compulsory.

Download Question Paper :

ACC :

https://www.pdfquestion.in/uploads/pdf2019/34539-mba.pdf

BSA :

https://www.pdfquestion.in/uploads/pdf2019/34539-mbabsa.pdf

ME :

https://www.pdfquestion.in/uploads/pdf2019/34539-mbame.pdf

MOB :

https://www.pdfquestion.in/uploads/pdf2019/34539-mbamob.pdf

Part-A

1.a.What is Contra entry? Give example. (3 Marks)

b. How Investor will be benefited by Ratio Accounting? (7 Marks)

c. Give accounting equation for the following transactions of Hitesh for the year 2009. (10 Marks)

i. Started business with cash Rs. 18,000.

ii. Paid rent in advance Rs. 400.

iii. Purchased goods for cash Rs. 5000 and on credit Rs. 2,000.

iv. Sold goods for cash Rs. 4,000 (costing Rs. 2,400).

v. Rent paid Rs. 1,000 and rent outstanding Rs. 200.

vi. Bought motor-cycle for personal use Rs. 500.

vii. Purchased equipments for cash Rs. 500.

viii. Paid to creditors Rs. 600.

ix. Depreciation on equipment Rs. 25.

x. Business expenses Rs.400.

2.a. Distinguish between Direct and Indirect tax. (3 Marks)

b. “Human Resource Accounting is a management tool which is designed to assist the Senior

management for taking business decisions” Justify (7 Marks)

c. Record the following transaction in three column cash book. (10 Marks)

1/3/2008 opened a Bank account with capital Rs. 1, 00,000 & cash in hand Rs. 40,000.

3/3/2008 paid into Bank Rs. 10,000.

5/3/2008 Bought Goods for Rs. 3,800 and paid by cheque.

6/3/2008 Sold goods for cash Rs. 2,600 & deposited the same into the Bank.

7/3/2008 Sold goods to Mr. X an account Rs. 10,000.

10/3/2008 Paid Mr. A by cheque Rs. 240 receiving a discount of Rs.10.

15/3/2008 Received a cheque from Mr. Vikas Rs. 1080 and allowed him Discount Rs. 20.

16/3/2008 Received a cheque from Mr. Santhosh Rs. 4000.

3.a. List out any six items deductible under Section 80C. (3 Marks)

b. Briefly explain the benefits and challenges of IFRS (7 Marks)

c. From the following information prepare Cash Flow Statement by Indirect Method. (10 Marks)

(i) The net profit for the year after adjustment in respect of provisions for dividends and taxation was Rs. 10,00,000

There was addition to Fixed Assets during the year amounting to Rs. 4,00,000 and Depreciation for the year was Rs. 3,00,000

4 a. What is forensic accounting? (3 Marks)

b. Draw a table showing the Income tax slab rates for an individual (including Senior and super senior citizen) for the Current A.Y. (7 Marks)

c. The following Trial Balance has been prepared wrongly. You are asked to prepare the trial balance correctly.

Part-B

8. (Case Study)

The following is the trial balance of Mr. X of Bombay as on 31st Dec. 2009. Prepare a trading and profit and loss account for the year ended 31st Dec. 2009 and the balance sheet as on that data after taking into consideration the following adjustments.

Adjustments:

i. Stock on 31st Dec.2009 was Rs. 10,000.

ii. Debts worth Rs. 2000 should be written off as bad.

iii. Depreciate machinery by 5% and motor vans by 15%.

iv. Provision for bad & doubtful debts should be increased by Rs. 600.

v. Commission accrued & not received Rs. 500.

vi. Goods worth Rs. 500 were used by the proprietor for his personal use.

vii. On 20th Dec. 2009, a fire broke out in the shop & goods worth Rs. 2000 were completely destroyed. The insurance company accepted the claim for Rs. 1500 only & paid the amount on 1st Jan 2010.

You are require to compute

(i) Gross Profit (5 Marks)

(ii) Net Profit (7 Marks)

(iii) Prepare Balance Sheet (8 Marks)