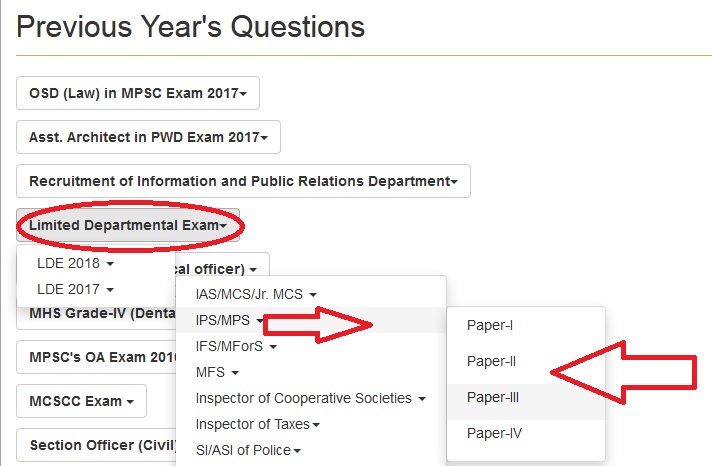

mpscmanipur.gov.in MPSC Limited Departmental Examination IPS/MPS Previous Year’s Questions

Organisation : Manipur Public Service Commission

Exam : Limited Departmental Examination

Post : IPS/MPS

Subject : Account – I & II,Civil Law

Year : 2017

Document Type : Previous Year’s Questions

Website : https://mpscmanipur.gov.in/question.html

MPSC LDE IPS/MPS Account – I & II Previous Question

Time Allowed: Two Hours

Maximum Marks: 100

Related : MPSC Limited Departmental Examination IAS/ IPS/IFS MCS/MPS/MFS/Jr. MCS Previous Years Questions : www.pdfquestion.in/33166.html

Instructions

1. Immediately after the commencement of the examination, you should check that this Test Booklet does not have any unprinted or torn or missing pages or items, etc. If so, get it replaced by a complete Test Booklet.

2. Write your Roll Number on the Test Booklet in the Box provided alongside.

3. This Test Booklet contains 100 items (questions). Each item comprises four responses (answers) written as (a), (b), (c) and (d). You will select the response which you feel is correct and want to mark on the answer sheet.

4. You have to mark all your responses ONLY on the separate Answer Sheet provided. Also read the directions in the Answer Sheet. Fill in all the entries in the Answer Sheet correctly, failing which your Answer Sheet shall not be evaluated.

5. Count the number of questions attempted carefully and write it down in the space provided in the OMR Sheet. This has to be verified by the Invigilator before leaving.

6. After you have completed filling in all your responses on the Answer Sheet and the examination has concluded you should hand over to the Invigilator the Answer Sheet (in original). You are permitted to take away 2nd Copy of OMR Answer Sheet and the Test Booklet.

7. All items carry equal marks.

8. Candidature would be cancelled in case of non-compliance with any of these instructions.

9. There will be NO PENALTY for wrong answers.

Download Question Paper :

Account – I :

https://www.pdfquestion.in/uploads/33174-LDEacci.pdf

Account – II :

https://www.pdfquestion.in/uploads/33174-LDEAccii.pdf

Civil Law :

https://www.pdfquestion.in/uploads/33174-LDEcivil.pdf

ACCOUNT-I

1. The combined Finance and Revenue Accounts of the Union and State Governments are prepared by –

(a) Indian Audit and Accounts Department ;

(b) Central Accounting Organisations of the Union Government ;

(c) Indian Accounts Department ;

(d) Comptroller and Auditor General of India.

2. The person whose duty it was to check such accounts became known as the auditor, the word being derived from the word ‘Audire’ which is a –

(a) French word ;

(b) Greek word ;

(c) Japanese word ;

(d) Latin word.

3. From January 26, 1950 (the date of commencement of the Constitution), as per Structure of Administration, India has been constituted into a Union of States comprising –

(a) 25 States and 7 Union Territories ;

(b) 27 States and 6 Union Territories ;

(c) 29 States and 7 Union Territories ;

(d) 32 States and 7 Union Territories.

4. The executive power of the Union vests in the –

(a) Lok Sabha ;

(b) Rajya Sabha ;

(c) President ;

(d) Prime Minister.

5. The executive power of the State vests in the –

(a) Legislature ;

(b) Chief Minister ;

(c) Governor ;

(d) Chief Secretary.

6. As per Article ____ of the Constitution of India, each State has a separate Consolidated Fund entitled the ‘Consolidated Fund of the State’ into which the revenues received by the Government of the State, loans raised by that Government by the issue of Treasury Bills, loans or ways and means advances and moneys received by that Government in repayment of loans are credited and from which the expenditure of the State, when authorized by the appropriate Legislature, is met –

(a) Article 265 ;

(b) Article 266 ;

(c) Article 267 ;

(d) Article 268.

7. A statement of its estimated annual receipts and expenditure is prepared by each Government and presented to its Legislature. The Union Territory |Governments present the Statement to its Legislature with the previous approval of the President. This ‘Annual Financial Statement’ is commonly known as the –

(a) Statement of Accounts ;

(b) Statement of Receipt and Expenditure;

(c) Statement of Receipt and Payment

(d) Budget.

8. In order to have a meaningful reflection of the national development effort and also as a means for evaluating the progress of projects against set targets as well as to serve as a tool for securing the efficient management of operations entrusted to the Administration, a system of ______ has been introduced both at the Centre and in the States.

(a) Action Plan ;

(b) Rapid Action Target ;

(c) Performance Budgeting ;

(d) Zero Base Budgeting.

9. The Finance Bill containing the annual taxation proposals is considered and passed by the Legislatures only after the Demands for Grants have been Voted and the total expenditure is known. Then it enters the Statute as the ______.

(a) Finance Act ;

(b) Appropriation Act ;

(c) Public Debt Act ;

(d) Contingency Fund of India Act.

10. The term ‘Ways and Means’ refers to methods of maintaining the Government’s daily cash balance at a level sufficient to meet its day-to-day requirements. All moneys received by or on behalf of Government either as dues of Government or by way of deposits, remittance or otherwise enter into the cash balance. The ____ acts as the Banker to the Central and State Government (except Jammu and Kashmir and Sikkim).

(a) State Bank of India ;

(b) United Bank of India ;

(c) Central Bank ;

(d) Reserve Bank.

11. Generally, the current receipts of Governments fall short of the current expenditure during the earlier part of the financial year and sometime exceptionally heavy payments in excess of cash balance have also to be made. In such cases, the Central Government borrows from the Reserve Bank against issue of ______, whenever necessary, for replenishing its cash balance.

(a) Vouched Contingent Bill ;

(b) Scale-Regulated Contingent Bill ;

(c) Countersigned Contingent Bill ;

(d) Treasury Bills.

12. All the States are divided into a number of ‘districts’ and at the headquarters of each district there is a Government treasury called the _____ with one or more sub-treasuries.

(a) State Treasury ;

(b) Directorate of Treasury ;

(c) District Treasury ;

(d) Government Treasury.

13. The Treasury Rules of each State Government provide that moneys may be received and payments made on behalf of the State Government, as well as Union Government, including Union Territory Governments and other State Governments. After the departmentalization of accounts of the Union Government, however, only certain limited category of transactions relating to the Union Government are permitted to be routed through the ______ and such transactions are initially taken under ‘Suspense’ pending settlement by cheque / demand draft with the Pay and Accounts Officer of the Ministry / Department concerned, by the Accountant General.

(a) Sub-Treasury ;

(b) District Treasury ;

(c) State Treasury ;

(d) Government Treasury.

14. At present, only the Loans / Grants from the Central Government to the States and the repayments of the loans and the interest by the State Governments to the Centre are settled through the medium of the _____________ and in other cases, the system is of settlement by cheque /draft.

(a) Controller of Accounts ;

(b) Director General of Accounts ;

(c) Comptroller & Auditor General ;

(d) Central Accounts Section of the Reserve Bank.

15. The initial accounts of receipts and payments on behalf of the State Governments are maintained at the State Treasuries in the respective States who compile and render them monthly to the ______ concerned.

(a) Controller of Accounts of the Department ;

(b) Pay and Accounts Office ;

(c) Accountant General ;

(d) Director General of Accounts.

16. An important duty of Audit in relation to borrowings is to see that the proceeds of loans are properly brought to account and that they are expended only on objects for which the loans were originally raised or to which borrowed moneys may properly be applied in accordance with the sound principles of ______.

(a) Public Debt ;

(b) Institutional Finance ;

(c) Public Finance ;

(d) Private Finance.

17. The currency of India consists of coins issued under the Indian Coinage Act, 1906, as amended from time to time, one rupee notes issued by the Ministry of Finance and bank notes issued by Reserve Bank of India. Under the provisions of the Reserve Bank of India Act, 1934, the sole right to issue bank notes in India has been vested in the Reserve Bank with effect from April, ____.

(a) 1934 ;

(b) 1935 ;

(c) 1936 ;

(d) 1937.

18. Bank notes issued by the Reserve Bank are of denominational value of two rupees, five rupees, ten rupees and one hundred rupees in Ashoka Pillar and _____ designs and are legal tender throughout India.

(a) Rajendra Prasad ;

(b) Krishnamachari ;

(c) Mahatma Gandhi

(d) Jawaharlal Nehru.

19. At treasuries and sub-treasuries situated at places where there is no branchy or agency of the Bank, Government holds the _______ responsible for keeping sufficient funds to meet all Government disbursements and for maintaining the balances as low as possible in order that money may not be locked up unnecessarily.

(a) Ministry of Finance ;

(b) Governor of RBI ;

(c) Currency Officers ;

(d) Treasury Officer.

20. The transfer of funds between treasuries and sub-treasuries and branches and agencies of the Reserve Bank is effected for the most part through the medium of currency chests belonging to the ______.

(a) Ministry of Home Affairs ;

(b) Ministry of Finance ;

(c) Controller of Accounts ;

(d) Reserve Bank of India.

21. Assuming that there are no transactions elsewhere, the deposit of currency and bank notes in a currency chest decreases the amount of such notes in circulation and the deposit of rupees and rupee notes in the chest increases the assets of the ______.

(a) Department of Currency Management

(b) Department of Education and Protection Department

(c) Issue Department of the Bank ;

(d) Department of Banking Regulation.

22. With the phenominal growth and in the functions of Government involving huge outlays, accounts acquired a new dimension and the necessity for a more meaningful classification of transactions for presentation of Government operation in term s of functions, programmes and activities was actually felt. A team (_____) set up by the Government of India went into this question and made recommendations for reforming the structure of budget and accounts.

(a) Bhattacharjee Committee ;

(b) Ambedkar Committee ;

(c) Mukherjee Committee ;

(d) Patel Bhai Committee.

23. The recommendations of the team were accepted by the Government of India and the Comptroller and Auditor-General of India, with the approval of the President, prescribed revised classification Government transactions which were given effect to from _____ , by the Union, State and Union Territory Governments.

(a) 1972-73 ;

(b) 1973-74 ;

(c) 1974-75 ;

(d) 1975-76.

24. The Government Accounts are kept in the main ______ of accounts viz. (a) Consolidated Fund of India or State or Union Territory; (b) Contingency Fund of India or State or Union Territory and (c) Public Account.

(a) Divisions ;

(b) Parts ;

(c) Major Head ;

(d) Minor Head.

25. In Part-II, namely, Contingency Fund, of the Accounts are recorded the transactions connected with the Contingency Fund set up by the Government of India or of a State or Union Territory Government under _____ of the Constitution / Section 48 of the Union Territories Act, 1963.

(a) Article 267 ;

(b) Article 268 ;

(c) Article 269 ;

(d) Article 270.

26. In Part III, namely, _____, of the Accounts, the transactions relating to Debit (other than those included in Part I), ‘Deposits’, ‘Advances’, ‘Remittances’ and ‘Suspense’ are recorded.

(a) Public Debt ;

(b) Public Account ;

(c) Consolidated Fund ;

(d) Contingency Fund.

27. The main unit of classification in accounts is ______

(a) Major head ;

(b) Minor Head ;

(c) Sub-Head ;

(d) Sub-Major Head.

28. Major Heads of account falling within the Consolidated Fund generally correspond to –

(a) Functions ;

(b) Programme ;

(c) Activity ;

(d) Object.

29. With effect from 1st January, 1982 and in the case of Jammu and Kashmir, Maharashtra, Manipur and Sikkim from 15th January, 1982, State Governments have been entrusted with their consent, in terms of Clause (1) of ______ of the Constitution, the functions of the Central Government under Article 150 of the Constitution in so far as such functions relate to the opening of sub-heads and detailed heads of accounts under the various Major and Minor Heads of Accounts in the State concerned.

(a) Article 258 ;

(b) Article 259 ;

(c) Article 260 ;

(d) Article 261.

30. The detailed classification of account heads in Government Accounts and the order in which the Major and Minor Heads shall appear in all account records shall be such as are prescribed by the Central Government from time to time on the advice of the _______.

(a) Assistant Comptroller & Auditor General ;

(b) Additional Deputy Comptroller & Auditor General ;

(c) Deputy Comptroller & Auditor General ;

(d) Comptroller & Auditor General of India.

31. With effect from______, the President in terms of Clause (1) of Article 239 of the Constitution, has directed the Administrators of the Union Territories of Arunachal Pradesh, Daman and Diu, and Pondicherry, subject to his control, also to discharge the functions of the Central Government under Article 150 of the Constitution in so far as such functions relate to the opening of sub-heads and detailed heads of accounts under the various Major and Minor Heads of Accounts within their respective territories.

(a) 1st January, 1987 ;

(b) 1st March, 1987 ;

(c) 1st April, 1987 ;

(d) 1st June, 1987.

32. In the coding pattern, the 1st digit in the Major Heads under ‘Receipt Heads’ (Revenue Account) is either 0 or 1, and the first digit for corresponding Major Heads for the same function in the Sections ‘Expenditure Heads’ (Revenue Account) ‘Expenditure Heads’ (Capital Account), and ‘Loans and Advances’ are derived by adding the number ____ to the first digit in the Major Heads in the ‘Receipt Head’ (Revenue Section).

(a) 0 or 02 ;

(b) 2 ;

(c) 3 ;

(d) 4.

33. Taxes collected by Government are classified under –

(a) Consolidated Fund ;

(b) Contingency Fund ;

(c) Public Account ;

(d) Public Debt.

34. The treasury system under which the District Treasury is the basic unit and the focal point for the primary record of financial transactions of Government in the District with sub-treasuries under it at the Taluks / Tehsils in the District, was evolved more than ____.

(a) 40 years ago ;

(b) 50 years ago ;

(c) 80 years ago ;

(d) a century ago.

35. The ______ of the District is in general charge of the treasury and is personally responsible for its general administration, for the correctness of its returns and the punctuality of their submission, and for the safe custody of the cash and other valuables it contains ; but he takes no part in the daily routine of treasury business.

(a) Block Development Officer concerned ;

(b) Sub-Deputy Collector concerned ;

(c) Sub-Divisional Officer concerned ;

(d) Collector or Deputy Commissioner.

36. Both the _____ and Treasurer being present, the locks and seals of the gates of the strong-room are made over intact by the guard and the room is opened, each official using his own key, and sufficient cash and notes to meet the probable demands of the day are taken out, made over to the Treasurer, and entered in his accounts.

(a) District Collector ;

(b) Deputy Commissioner ;

(c) Assistant Deputy Commissioner

(d) Treasury Officer.

37. In the case of receipts, the treasury checks the correctness of classification and completeness of the _____.

(a) Bills ;

(b) Challans ;

(c) Vouchers ;

(d) Sub-Vouchers.

38. In the cases where challans are countersigned by the departmental officers and the treasury does not handle cash business of the Government, _______ ensures the correctness of classification and completeness of challans and the depositor makes the remittances direct at the Bank.

(a) the Treasury Officer ;

(b) the Sub-Treasury Officer ;

(c) the Assistant Treasury Officer ;

(d) the departmental officer countersigning the challans ;

39. Currency Officers (RBI) are responsible for –

(a) Supplying coins to treasuries ;

(b) Supplying coins and notes to treasuries

(c) Arranging for transfer of funds between treasuries and banks and remittance of money between treasury and Currency Office ;

(d) Combination of all these functions.

40. The Finance Accounts of the Government are generally prepared in _____ part(s).

(a) 1 (one) part ;

(b) 2 (two) parts ;

(c) 3 (three) parts ;

(d) 4 (four) parts ;

ACCOUNT-II

1 Permanent post means a post carrying a _____ sanctioned without limit of time.

(a) Definite rate of pay ;

(b) Variable rate of pay ;

(c) Both (a) & (b) ;

(d) None of the above.

2. Personal pay means additional pay granted to a Government employee –

(a) To save him from loss of substantive pay ;

(b) In exceptional circumstances on other personal considerations ;

(c) All the above ;

(d) None of the above.

3. The maximum period for which a person can retain Government accommodation on normal license fee upon transfer to an ineligible office at the same station is –

(a) Three months ;

(b) Two months ;

(c) Six months ;

(d) 15 days.

4. Which of the following entry is not recorded in the Service Book ?

(a) Pay fixation ;

(b) General Provident Fund ;

(c) Leave ;

(d) Leave Travel Concession (LTC).

5. Which of the following is not included in duty ?

(a) Probation time ;

(b) Training time ;

(c) Joining time ;

(d) Leave period.

6. As per recommendations of Sixth Pay Commission, what is the possible date of next increment at the time of promotion if the official opts to get his pay fixed in the higher grade from the date of his promotion ?

(a) Date of promotion ;

(b) 1st July of next year ;

(c) Either (a) or (b) ;

(d) 1st January of next year.

7. The period of wilful absence is treated as ‘dies non’ for –

(a) Increments ;

(b) Leave ;

(c) Pension ;

(d) All of the above.

8. If an ad-hoc promotion is followed by regular promotion without break, the option may be allowed to the Government employee from the date –

(a) Regular promotion ;

(b) Initial appointment to the higher post ;

(c) Next increment ;

(d) None of the above.

9. Employees drawing grade pay of Rs. 5,400/- and above are entitled to Transport Allowance of Rs. 3,200/- plus DA thereon. When the Government employee is absent from Headquarters of posting for a full calendar month, he will be entitled to –

(a) ‘Nil’ transport allowance ;

(b) Full transport allowance ;

(c) ½ transport allowance ;

(d) None of the above.

10. Every Government employee shall retire, except exceptional circumstances, from service on the afternoon of the last day of the month in which he attains the age of –

(a) 58 years ;

(b) 60 years ;

(c) 62 years ;

(d) 65 years.

11. Average pay means –

(a) One month pay ;

(b) Average of monthly pay earned during the 12 complete months ;

(c) Average of monthly pay drawn during the last ten months of service ;

(d) Pay drawn in the month in which last increment was drawn.

12. Duty includes this period of –

(a) Service not verified ;

(b) Unauthorised leave ;

(c) On training ;

(d) Break in service.

13 Monthly grant made to a Government employee who is not in receipt of pay or leave salary is –

(a) Subsistence grant ;

(b) Substantive grant ;

(c) Personal grant ;

(d) Temporary grant.

14. A Government employee will be eligible for increment on 1st July, if he completes his service for –

(a) More than one financial year ;

(b) More than one calendar year ;

(c) Six months and above ;

(d) At least three months.

15. The CCS(RP) Rules, 2008 are effective from –

(a) 01/01/2006 ;

(b) 01/04/2006 ;

(c) 01/01/2007 ;

(d) 01/04/2007.

16. License fee is related –

(a) Government vehicles ;

(b) Government accommodation ;

(c) Education ;

(d) None of the above.

17. If a Government employee is on leave from 25th June to 30th June of a year suffixing holiday on 1st July and resuming duty on 2nd July, his increment will be drawn from –

(a) 1st July ;

(b) End July ;

(c) 1st August ;

(d) None of the above.

18. Any Government employee may, by giving notice of ______ in writing to the appropriate authority, retire from the service after he has attained prescribed age –

(a) Not less than three months ;

(b) Less than three months ;

(c) Not less than two months ;

(d) Less than two months.

19. Service Book is to be shown to the official concerned in –

(a) Every block of years ;

(b) Every year ;

(c) Every six months ;

(d) Every three months.

20. Extraordinary leave is granted to a Government servant due to his inability to join or rejoin duty or on account of civil commotion the period of leave can be counted for grant of increment under FR –

(a) 26(a) ;

(b) 26(b) ;

(c) 22(c) ;

(d) 26(e).