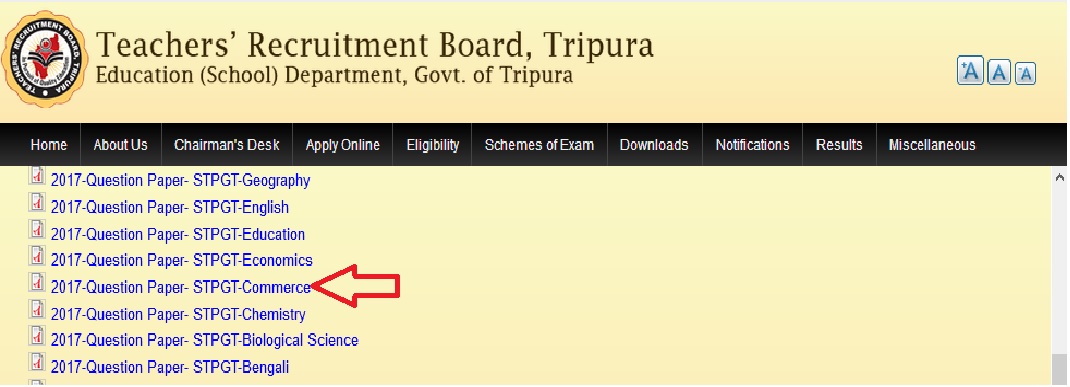

trb.tripura.gov.in STPGT Commerce Previous Question Paper 2017 : Selection Test for Post Graduate Teachers

Organisation : Teachers’ Recruitment Board, Tripura

Exam : STPGT – Selection Test for Post Graduate Teachers

Document Type : Previous Year Question Paper

Subject : Commerce

Code No : AF17—XVIII

Year : 2017

Website : https://trb.tripura.gov.in/

TRB Tripura STPGT Commerce Previous Question Paper

Question Paper of TRB Tripura Selection Test for Post Graduate Teachers Commerce Question Paper 2017 is now available in the official website of Teachers’ Recruitment Board, Tripura.

Related : TRB Tripura STPGT Economics Question Paper 2017 : www.pdfquestion.in/29566.html

Instructions for Candidates

1. Use Black Ballpoint Pen only for writing particulars of this Question Booklet and marking responses on the OMR Answer Sheet.

2. This test is of 2 hours and 30 minutes duration and consists of 75 MCQ-type questions. Each question carries 2 marks.

3. There is no negative marking for any wrong answer.

4. Rough work should be done only in the space provided in the Question Booklet.

5. The answers are to be marked on the OMR Answer Sheet only. Mark your responses carefully since there is no chance of alteration/correction.

6. Use of eraser or whitener is strictly prohibited.

Download Question Paper :

https://www.pdfquestion.in/uploads/STPGTComm.pdf

Model Questions

Direction : Answer the following questions by selecting the correct option.

1. Which one of the following is an exception to the convention of conservatism?

(A) Making provision to doubtful debts in anticipation of actual bad debtors

(B) Valuation of stock at market price or cost price whichever is higher

(C) Charging of small capital item as revenue

(D) Adopting written-down value method of depreciation as against straight-line method

2. Which one of the following is correct accounting equation?

(A) Asset = Owner’s equity

(B) Asset = Liabilities + Owner’s equity

(C) Asset = Liabilities – Owner’s equity

(D) Asset + Liabilities = Owner’s equity

3. Which one of the following pairs is not a perfect match?

(A) Suppression of invoice—Window dressing

(B) Overcharging of depreciation— Secret reserve

(C) Omission of cash receipts from debtors—Understatement of sales

(D) Omission of credit sales— Understatement of debtors

4. Which one of the following is correct with respect to going concern convention?

(A) The enterprise is not going to terminate its operation in the period ahead

(B) The enterprise may go out of business in the next accounting period

(C) The enterprise may not divert or diversify its operational spheres

(D) The enterprise may not revalue its asset during the current accounting period

5. Which one of the following items is considered as revenue expenditure?

(A) Expenditure by the way of maintenance for increased productivity

(B) Repair of a car engine for enhancement of operational life

(C) Complete overhaul of a machine, spending around 22% of its value

(D) Changing a small component of a machine to maintain its operational efficiency

6. During shifting to their new building, M/s XYZ Ltd. has spend R 20,000 for pulling down the old structure and R 2,000 for shifting of stock to new building. These expenditures are to be classified as

(A) capital expenditure

(B) revenue expenditure

(C) capital expenditure and revenue expenditure respectively

(D) deferred revenue expenditure

7. Preparation of Trial Balance helps mainly in

(A) summarising business transactions

(B) verifying that ‘GAAP’ has been observed

(C) finalising the sources and uses of fund’s statement

(D) locating errors, if any, in the books of accounts

8. If

Opening stock = R 2,45,000

Purchase = R 15,00,000

Sales = R 17,40,000

and the rate of gross profit = 20% on cost of goods sold, then the closing stock would be

(A) R 3,53,000

(B) R 2,95,000

(C) R 2,45,000

(D) R 1,95,000

9. Income earned but not yet received is treated as

(A) asset

(B) liability

(C) loss

(D) capital

10. The capital of a firm is R 80,000. The reasonable return in the industry is 7·5%. If the profits earned by the firm during last five years were R 8,000, R 9,000, R 7,000, R 8,500 and R 10,000, then the superprofit of the firm is

(A) R 2,000

(B) R 2,500

(C) R 3,000

(D) R 3,500

11. A and B are the partners in a firm sharing profit and losses in the ratio of 2 : 3. C, a new partner is admitted for 1/4th share. The new profit sharing ratio of A, B and C would be

(A) 1 : 1 : 1

(B) 2 : 3 : 4

(C) 1 : 2 : 2

(D) 6 : 9 : 5

12. Call option is

(A) a contract to buy a certain number of shares at a stated price within a specific period of time

(B) a contract to sell certain number of shares at a stated price within a specific period of time

(C) the option of issuing company to demand the shareholders to pay for partly paid shares

(D) the option available to the convertible debenture holders to demand equity shares in conversion of debentures

13. Provisions are amounts set aside out of profit and other surpluses for

(A) meeting a liability, the amount which can be determined with exact figure

(B) any known liability which the amount cannot be determined with substantial accuracy

(C) meeting an eventuality arising out of revaluation of asset in ordinary course of business

(D) meeting a liability arising out of arbitration

14. A trader does not keep a complete set of books and gives the following information :

Started business with R 10,000 on 1st June, 2014. Drawings @ R 500 for the last six months. Further capital introduced during the year R 2,000. On 31st Dec, 2014, his total asset was R 23,700 and his creditors were R 3,000 on the same date. Outstanding expenses on that date were R 500. His net profit during the year would be

(A) R 11,200

(B) R 11,500

(C) R 13,000

(D) R 14,200

15. Which of the following fixed assets is not depreciated in the ordinary circumstances?

(A) Plant and machinery

(B) Building

(C) Land

(D) Equipments

16. The purchase price of a software that will be used for more than 12 months should be regarded as a/an

(A) revenue expenditure

(B) capital expenditure

(C) long-term expense

(D) accounting period expense

17. Cost of a fixed asset – Accumulated depreciation expenses of the fixed asset =

(A) Book value of the fixed asset

(B) Market value of the fixed asset

(C) Historical cost of the fixed asset

(D) Recoverable amount of the fixed asset

18. Which of the following result in unadjusted cash book balance?

(A) Outstanding cheque

(B) Unpresented cheque

(C) Deposit in transit

(D) Omission of bank charges

19. In the bank reconciliation statement, ‘deposit in transit’ is usually

(A) subtracted from bank balance

(B) added to bank balance

(C) added to cash book balance

(D) subtracted from cash book balance

20. From the following adjusting double entries, find the correct one for prepaid expenses.

(A) Debit = Expenses, Credit = Prepaid expenses

(B) Debit = Prepaid expenses, Credit = Expenses

(C) Debit = Cash, Credit = Prepaid expenses

(D) Debit = Expenses, Credit = Cash

21. Which of the following is a common base for preparing a Trial Balance?

(A) Ledger Account

(B) General Journal

(C) Specialised Journal

(D) Balance Sheet

22. When is the Trial Balance generally prepared?

(A) Frequently during the year

(B) At the end of accounting period

(C) At the end of a month

(D) At the end of a year

23. Mention the correct sequence of accounting process.

(A) Communicating ® Recording ® Identifying

(B) Recording ® Communicating ® Identifying

(C) Identifying ® Recording ® Communicating

(D) Identifying ® Communicating ® Recording

24. ‘Equity’ means

(A) cash from the business

(B) liability of a business

(C) owner’s claim on total asset

(D) owner’s claim on total liabilities

25. What implies for double entry?

(A) Recording entries in journal

(B) Recording entries in ledger account

(C) Recording two aspects of every transaction

(D) Recording every transaction in books

26. Find the nominal account from the following.

(A) Machinery A/c

(B) Building A/c

(C) Creditors A/c

(D) Rent expenses A/c

27. The written agreement of partnership is most commonly referred as

(A) agreement

(B) partnership deed

(C) partnership account

(D) partnership act

28. Which is the correct double entry for realisation of profit at the time of dissolution of partnership?

(A) Debit Realisation, Credit Bank

(B) Debit Bank, Credit Realisation

(C) Debit Realisation, Credit Partner’s Capital

(D) None of the above

29. What will happen if bad debt is not recorded by a firm by mistake?

(A) Net profit would decrease

(B) Net profit would increase

(C) Gross profit would overstate

(D) Gross profit would understate

30. Mr. Maniram, who holds 100 shares of 10 each, fails to pay a final call of R 2. The directors forfeited all the shares and subsequently reissued 50 shares at R 6 as fully paid. The amount to be transferred to capital reserve would be

(A) R 200

(B) R 300

(C) R 400

(D) R 800