actuariesindia.org ACET Actuarial Risk Management Question Paper 2016 : Institute Of Actuaries Of India

Name of the Organisation : Institute Of Actuaries Of India

Exam : Actuarial Common Entrance Test – ACET

Subject : CA1 – Actuarial Risk Management

Year : 2016

Document Type : Previous Years’ Question Papers

Website : https://actuariesindia.org/

Download Model/Sample Question Paper :

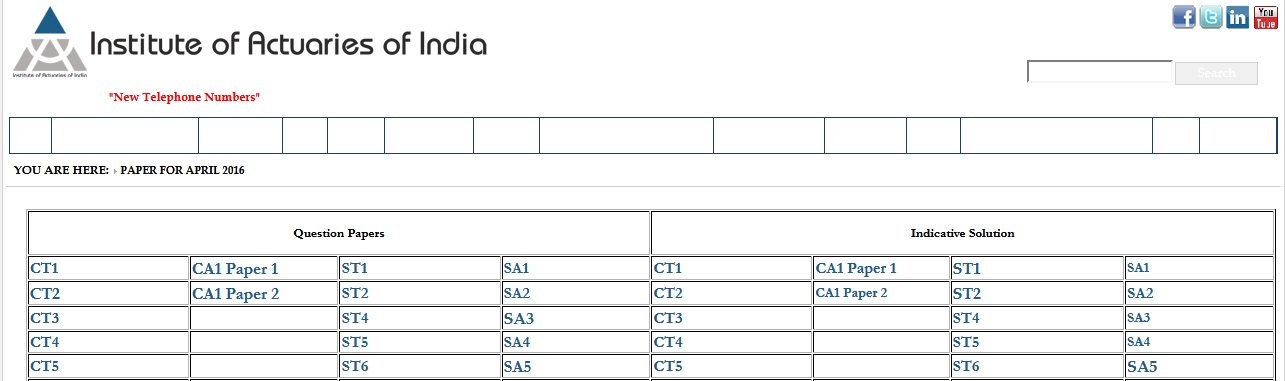

CA1 Paper 1 : https://www.pdfquestion.in/uploads/13265-CA1IQP.pdf

CA1 Paper 2 : https://www.pdfquestion.in/uploads/13265-CA1IIQP.pdf

ACET Actuarial Risk Management Question Paper

Time allowed: 3 Hours (14.45* – 18.00 Hrs)

Total Marks: 100

Related : Institute Of Actuaries Of India ACET Financial Mathematics Question Paper 2016 : www.pdfquestion.in/13260.html

Instructions

1. Please read the instructions on the front page of answer booklet and instructions to examiners sent along with hall ticket carefully and follow without exception.

2. Attempt all questions, beginning your answer to each question on a separate sheet.

3. *You have 15 minutes at the start of the examination in which you are required to read the questions. You are strongly encouraged to use this time for reading only, but notes may be made. You then have 3 hours to complete the paper.

4. You must not start writing your answers until instructed to do so by the Supervisor.

5. Mark allocations are shown in brackets.

6. Please check if you have received complete Question Paper and no page is missing. If so kindly get new set of Question Paper from the Invigilator

Model Questions

Q. 1) i) Define tactical asset allocation and outline the factors to consider while making a tactical asset switch. (3)

ii) Which liabilities should be considered by the investment manager while determining his investment strategy- liabilities derived using realistic basis or statutory basis? 2) [5]

Q. 2) i) List the rating factors that could be used to price private motor insurance policy. (3)

ii) A company is planning to introduce long term single premium motor insurance policy for a policy term of 3 years. Discuss the additional factors that need to be taken into account while setting the premium rates. (4) [7]

Q. 3) i) Describe the principal economic factors which influence bond yields (6)

ii) Discuss the comment “Equity is the best investment when invested for long term”. (5) [11]

Q. 4) A large IT company provides a defined benefit pension scheme to its employees. An employee is eligible to receive defined benefits on retirement only if he/she has completed a minimum of 5 years of service with the company. The retirement benefits are based on final salary and length of service in the company. The benefit is also payable on early retirement on grounds of ill health/death whilst still employed with the company.

i) Why would the company offer such a defined pension scheme? (2)

ii) List the various assumptions needed to value the scheme. (4)

iii) Outline the risks to the employer and employees from the scheme. (6) [12]

Q. 5) i) You are an investment expert advising clients on personal investments. Outline the factors you shall consider while providing advice to a professional in his twenties who has just started his professional career. (5)

ii) A large investment company, which has till now not invested in properties directly or indirectly, intends to start a property unit trust fund. Discuss the factors to consider in finalizing the following aspects of the fund’s investment strategy:

The range of the property assets it should invest in.

The proportion of the fund that should be held in liquid assets. (8) [13]

Q. 6) An established power company in Mumbai intends to install a solar power plant in Rajasthan for generation and transmission of power to various states.

i) Outline the information that would be needed to calculate the NPV for this project. (6)

ii) If the project is proven to be financially viable as per (i) above, discuss the other factors that should be considered before deciding on whether to go ahead with this project. (7) [13]

Q. 7) i) Outline the difference between forwards and futures. (3)

ii) Outline why investment funds may use derivatives. (3)

iii) A large investment company, intends to offer the following five-year product :

An investor has to make an initial lump sum investment. At the end of 5 years, the company would pay an amount equal to the initial lump sum increased in line with 95% growth of a local stock market index comprising 50 shares, subject to the amount being at least equal to the initial lump sum invested.

a) Outline two different investment strategies the investment company may adopt to meet the inherent guarantee. (4)

b) From the perspective of the investor and the investment company comment on the different financial risks relating to the above product. (9)